If you’re a renter, your rent is going to be one of, if not the biggest expense in your monthly budget. And when you’re trying to get out of debt, every dollar counts. Today I’m going to share with you three tips for renting a home.

Would you prefer to watch instead of read? You’re in luck! This video contains all of the information in this article.

Area Factors

There are a ton of factors to consider when it comes to finding and choosing a rental property, especially if you’re working on paying off debt. You need to consider how long your commute will be, whether or not you feel the neighborhood is safe, and how close you’ll be to places like grocery stores and shopping centers that you’ll be visiting on a regular basis. And that’s all before you begin to look at specific homes or apartments. It can be a huge challenge, especially if you’re unfamiliar with where you’re moving. So how can you make sure you end up with a great rental?

Tip 1: Determine Your Needs

Tip number one is to figure out what your needs are, separately from your wants. For example, you might want to live in a big home with lots of rooms and a nice long driveway. Or you might want to live in the penthouse apartment in the middle of downtown. Do you truly need to live in either of those places? Unlikely.

Think critically about how many bedrooms you actually need. Spare guest rooms are nice to have, but if having one adds $200 per month to your rent, you’re looking at spending an extra $2,400 per year – money that would be better off directed at your debts.

Do you feel you need that balcony off the master bedroom to relax outside? Maybe a common area in an apartment complex can serve the same purpose for you.

Do you feel you need to live in a single family home because you can’t stand having people living above and below you? Maybe a town home can enable you to avoid those upstairs and downstairs neighbors who are always making so much noise.

The more luxuries you’re willing to sacrifice now, the faster you’ll be done with your debt and on to the next stage in your life.

Tip 2: Evaluate Your Budget

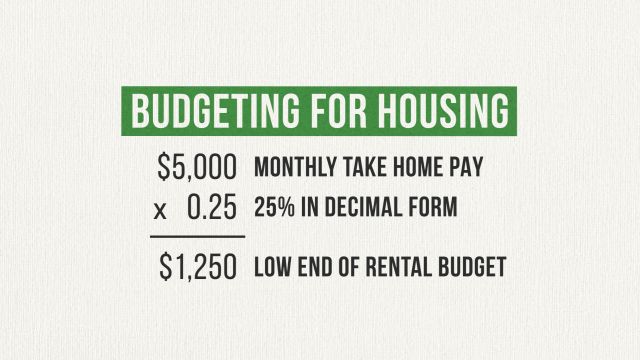

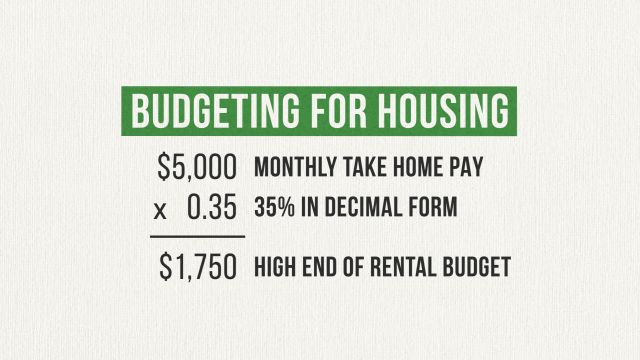

My second tip is to really evaluate your budget. How much are you comfortable spending on rent each month? Most advice online will recommend spending anywhere from twenty five to thirty five percent of your monthly take home pay on housing. To figure out what that number is for you, first you’ll need to determine the average amount of income you bring home each month. Then you can multiply that number by zero point twenty five to get the low end of the range, and by zero point thirty five for the high end.

Calculating Your Budget

Let’s say my household brings home five thousand dollars per month on average. If I take five thousand dollars and multiply it by zero point twenty five, I get one thousand, two hundred, and fifty dollars.

If I take five thousand dollars and multiply it by zero point thirty five, I get one thousand, seven hundred and fifty dollars. In general, that’s the range I want to be looking in when it comes to finding a rental home.

Let’s pretend my goal is to get out of debt and save up to purchase a home. Maybe even start saving for retirement. If I’m spending forty or fifty percent of my take home pay on rent, there probably won’t be much money leftover after all of my other monthly expenses to make big progress toward those goals.

What do you think? Do you feel like the twenty five to thirty five percent recommendation is unrealistic? Let me know in the comments.

Tip 3: Find a Local Landlord

So, you’ve decided what area you’d like to live in, what your needs are, and what your budget is. It’s time to start looking for an actual place to live. Where should you look? How do you find the best deal? Here’s tip number three – find a local landlord. In my experience renting for about ten years now, you’ll get the most bang for your buck if you find someplace where you’re dealing directly with the owner. I’m talking about someone who owns a few properties and rents them out.

Think about the situation from that person’s perspective – every month their property sits empty, they’re losing out on that rent money. In certain areas, after just two or three months, they could be out four or five thousand dollars in rent. That owner is going to be motivated to get the place rented, so they’re going to offer you a competitive price. And once you’re moved in, they’re going to treat you well as a tenant so that you’ll renew your lease keep renting from them.

Avoid the Massive Apartment Complex!

If you go to one of these massive apartment complexes with two or three hundred units, they don’t care as much if an apartment sits empty for a few months, nor do they really care if you renew or move out at the end of your lease. The only guarantees are that the rent will go up every year and that it will be a hassle to get anything fixed properly.

Where to look?

Where do I find these magical rentals? I’ve had great luck finding the last four places I’ve rented on Craigslist. From the beginning, I’ve dealt directly with the owner of each, and I’ve had a positive experience every time. And, in 10 years of renting, I’ve never had a rent increase when I wanted to renew. Knock on wood, right?!