Warning: This could change the course of your life forever.

It sounds cliche, but learning how to create a budget in Excel or in Google Sheets and actually taking the time to do so on a monthly basis has quite possibly been the biggest key to success in my journey to become debt free. In this article, I’m going to share with you my philosophy on budgeting, show you the basics of how I create a budget in Excel, and demonstrate how you can take control of your money with this simple monthly practice.

Would you prefer to watch instead of read? You’re in luck! This video contains all of the information in this article.

The Backstory

Two years ago, I realized that I had no idea what a personal monthly budget actually was. All I had was a short list of fixed monthly expenses like rent, student loan payments, and car insurance scribbled on a Post-It note, stuck to my computer monitor. I thought for sure I was budgeting in my business, but I was merely keeping a record of all of my purchases and entering them into Quickbooks. I guess it was better than nothing, but that’s really not saying much.

I was out running one morning, listening to a popular personal finance podcast, when I came to realize that I’d never created a budget in my life. A budget is not simply knowing when your monthly bills are due and making sure there’s enough money in your bank account to cover them when the payments are drafted. Nor is it keeping a record of what you spent and evaluating it after the fact. Budgeting, as I realized that morning, is determining how much income you’re going to have in a given month, and planning in advance – I want to highlight that part – in advance – how every single dollar of that income is going to be spent. A few weeks later I learned and started using the phrase “spending plan” in place of the word “budget.” Things were starting to make a lot more sense to me.

Creating the Budget

Now that you and I both understand what a budget truly is, I want to show you how I create one. My favorite way to create a budget is with a spreadsheet, so that’s how I’m going to show you today. If you prefer, you can use an app like Every Dollar – which is free, by the way – or just get out the trusty pen and paper if you prefer to keep things analog.

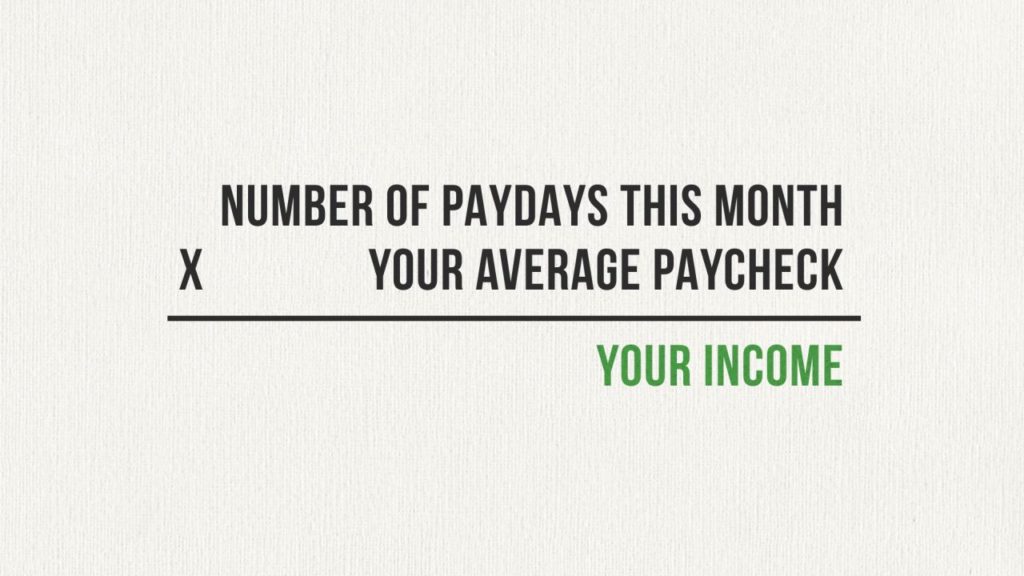

At the very top of the spreadsheet, I add a section for income. I figure out how much money I’ll have going into my bank account this month, and I put it in this section. If you’re not sure how to figure this out, just determine how many paydays there are this month, and then multiply it by your average paycheck.

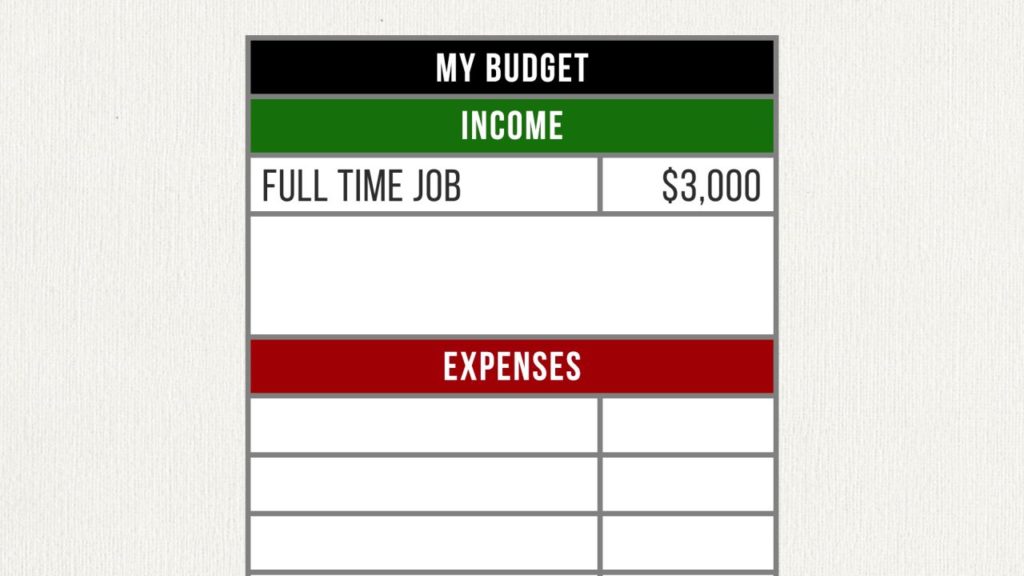

To keep it simple, let’s say my income this month is going to be three thousand dollars.

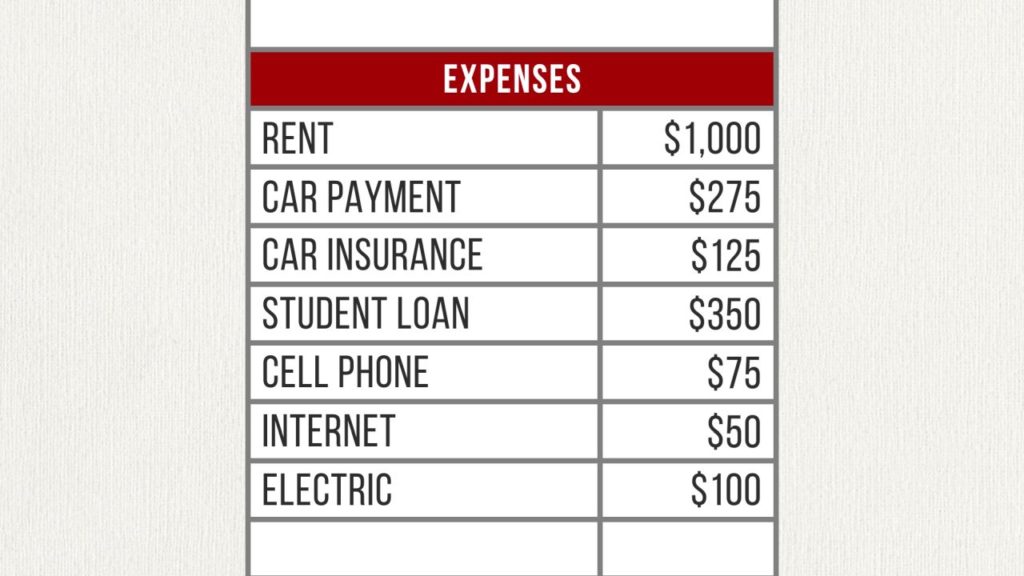

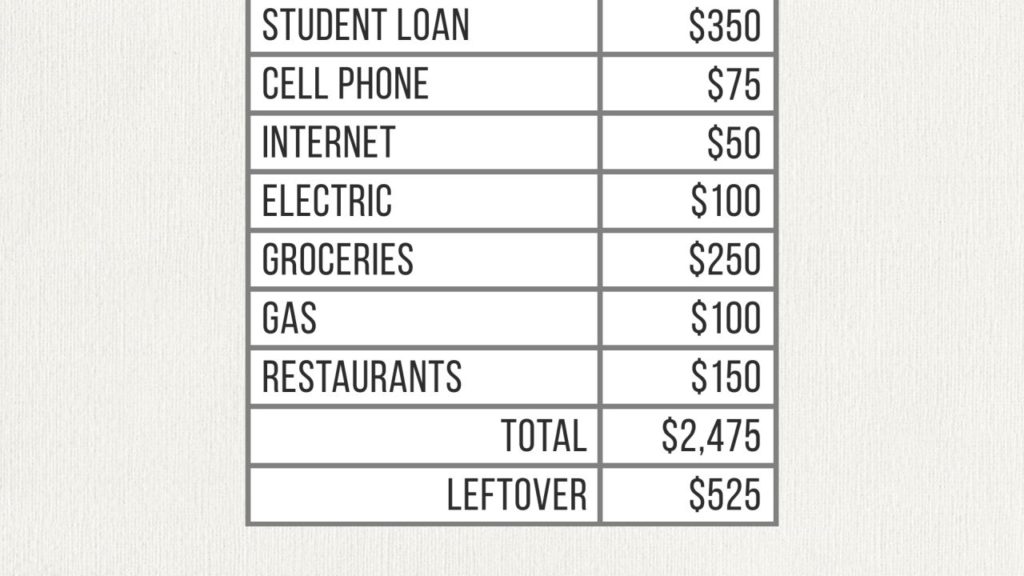

In the next several boxes, I’ve listed out my expenses, starting with some fixed expenses like one thousand dollars for rent, two hundred and seventy five dollars for a car payment, one hundred twenty-five dollars for car insurance, three hundred fifty dollars for a student loan payment, seventy five dollars for cell phone service, and fifty dollars for internet service. These expenses are pretty easy to plan for, since I don’t have much of a say about the amounts.

My electricity bill, on average, is about eighty to ninety dollars per month, so I’m going to set aside one hundred dollars to make sure that’s covered.

Then there are expenses which can fluctuate a bit more based on my habits. These are things like groceries, gas for the car, and dining out. With these, I get to choose, to some extent, how much money I’m going to spend.

Let’s say I commit to spending no more than two-hundred fifty dollars on groceries, one hundred dollars on gas, and one hundred fifty dollars dining out. So far, my expenses total two thousand, four hundred, and seventy five dollars. That means I’ve still got five hundred twenty five dollars left to plan for.

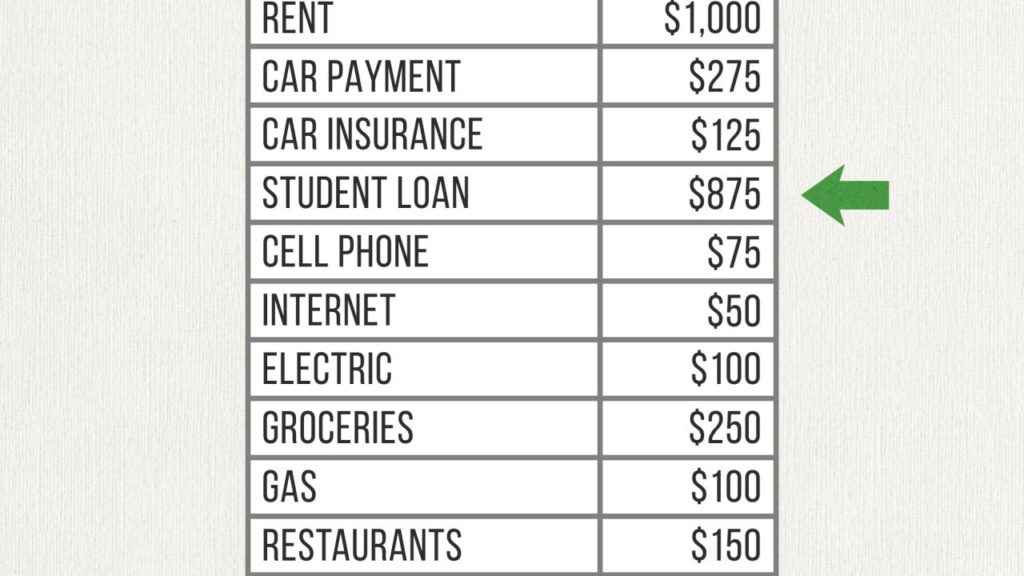

Here is a key part where creating a budget can help you achieve your goals. If one of my goals is to pay off that student loan as fast as possible, I’m going to plan on taking that extra five hundred twenty five dollars I have leftover and make an additional payment on that loan, making the total amount for the student loan payment eight hundred seventy five dollars this month.

Now that I’ve got my plan laid out, I just need to stick to it. I see a new pair of shoes I really want? “Nope, not in the budget.” My co-workers invite me to happy hour for drinks but I’ve already spent one hundred fifty dollars at restaurants this month? “Sorry, I can’t go!” Are you starting to see a pattern here? Having a budget gives you the power to say that magic word: NO!

Next I want to talk about the most difficult part about all of this. Are you ready? It’s actually doing it! Like many things in life, budgeting is so much easier said than done. It’s easy to read this article and feel like you’ve accomplished something by gaining some new knowledge, but the real, positive change in your life will only happen when you take this knowledge and apply it consistently.

So with that, I’m challenging you to create and live on a budget this month. I’m betting most people who read this won’t actually do it, but those who do will be taking their first steps toward success with money.

Got any questions about your budget? Leave a comment below and I’ll do my best to help!